Choosing the best cover for your family

Many insurance companies offer the same insurance, but choosing the right insurance for your family is never easy because taking out insurance is not as simple as just picking the available one. You need to select the insurance company with your best interest in mind, has the most affordable plan, and is committed to working very hard to ensure its customers are well taken care of and set at ease. ZARFINCO has hired the best team that works hard, so you do not have to.

Zarfinco has partnered with Old Mutual and Safrican to bring you the best Life-insurance and funeral insurance at a very affordable price. ZARFINCO has the best insurance quote to fit your budget and lifestyle. Do not let life's unforeseen challenges derail you. Take the time to join ZARFINCO and live a peaceful life amid the worst storms.

The 100% black-owned insurance company is a wise choice because it allows you to take control of your future and that of your loved ones. Our funeral plan options provide you and your family with the financial and practical support you need in difficult situations.

Our life insurance ensures that you protect yourself and your family's future. At ZARFINCO, you can choose from multiple innovative, flexible term life plans at affordable rates.

Our cover ranges from R5000 to R70000, starting from as little as R29 per month. Does this seem reasonable and fit your budget? Let our call centre team help you make the right decision.

Many insurance companies offer the same insurance, but choosing the right insurance for your family is never easy because taking out insurance is not as simple as just picking the available one. You need to select the insurance company with your best interest in mind, has the most affordable plan, and is committed to working very hard to ensure its customers are well taken care of and set at ease. ZARFINCO has hired the best team that works hard, so you do not have to.

Zarfinco has partnered with Old Mutual and Safrican to bring you the best Life-insurance and funeral insurance at a very affordable price. ZARFINCO has the best insurance quote to fit your budget and lifestyle. Do not let life's unforeseen challenges derail you. Take the time to join ZARFINCO and live a peaceful life amid the worst storms.

The 100% black-owned insurance company is a wise choice because it allows you to take control of your future and that of your loved ones. Our funeral plan options provide you and your family with the financial and practical support you need in difficult situations.

Our life insurance ensures that you protect yourself and your family's future. At ZARFINCO, you can choose from multiple innovative, flexible term life plans at affordable rates.

Our cover ranges from R5000 to R70000, starting from as little as R29 per month. Does this seem reasonable and fit your budget? Let our call centre team help you make the right decision.

By: Eunice Mukondeleli

Published on: 04/01/2023

Hard work doesn't go unnoticed at ZARFINCO

Hard work doesn't go unnoticed at ZARFINCO

The Zarfinco staff had a blast at the Christmas party held at Sandton as a token of appreciation for the efforts put in throughout the year, as the brand launch required added exertion with the training. The staff gave their best effort to Zarfinco. From the marketing team, the call centre and the management. The team worked as a team and achieved the best results.

Zarfinco is an insurance company that deals with Funeral Cover and Life cover. That needs hard workers. So far, the results are overwhelming. The CEO of Zarfinco, Mr Nkumane, gave employees awards and flowers for their

hard work.

“Give them their flowers while they are still alive”, Mr Nkumane said with a proud face. Both the management and staff were happy that their hard work did not go unnoticed.

Everyone had fun as the year-end event was refreshing and relaxing for everyone.

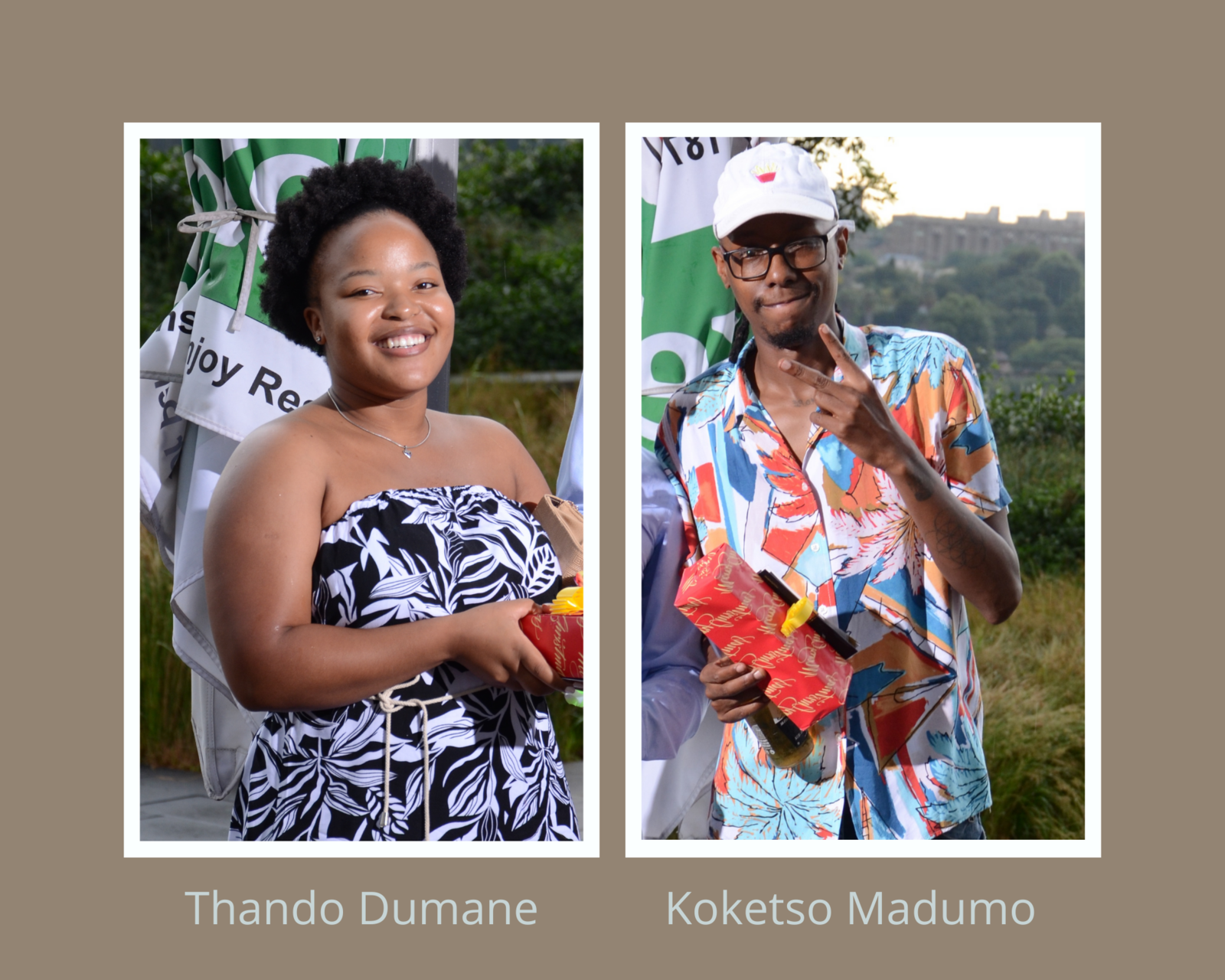

Thando Dumane received the, “The most proactive Zarfinco employee in 2022" award.

Koketso Madumo received an award for, “Best dressed male 2022”.

While their manager, Mr Luthuli, received flowers for managing the team well and being a team player.

The Zarfinco Team continues to work hard for you.

For a quote, visit the Zarfinco website and follow us on all social media platforms to stay updated.

By: Eunice Mukondeleli

Did you know

Did you know

THINGS YOU NEED TO KNOW ABOUT YOUR COVER:

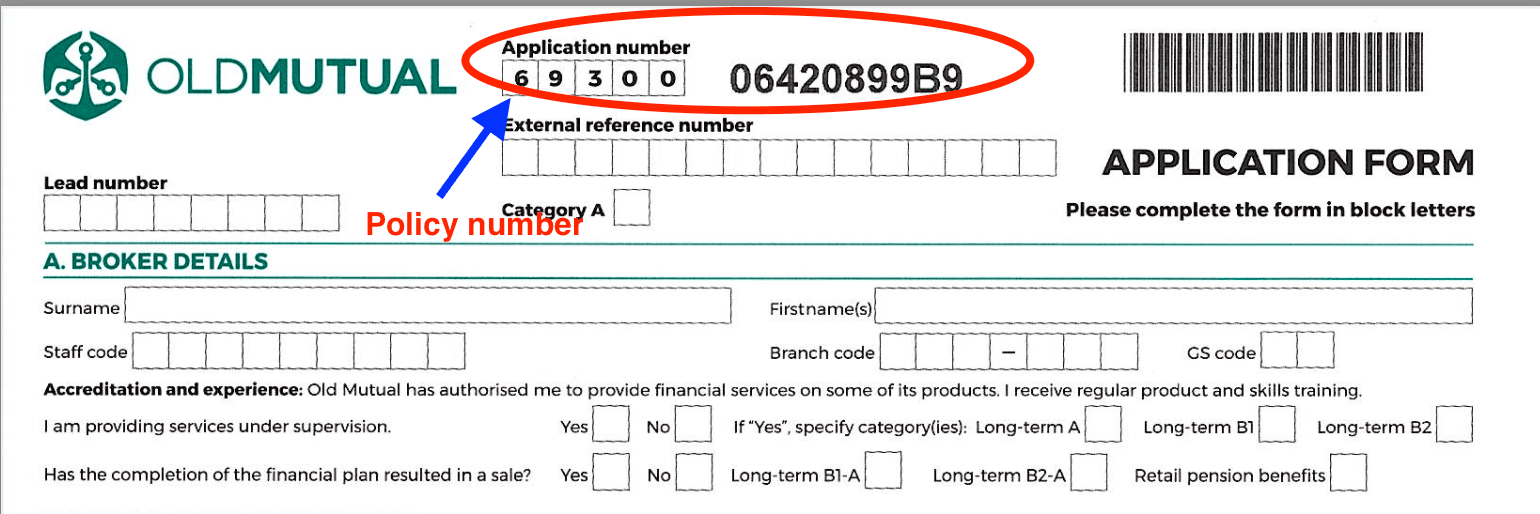

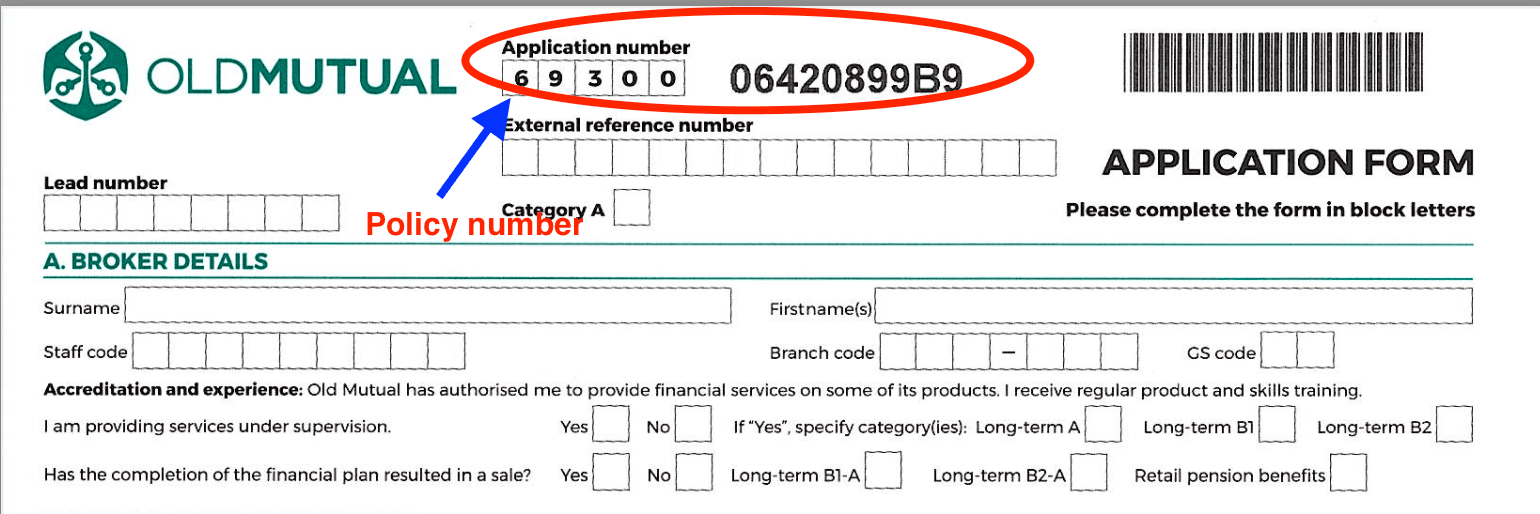

Policy number

A policy number is a unique number that identifies your particular cover. The policy number is quoted on your funeral cover document, however, the agent should give it to you immediately after you finish the telephonic/face-to-face onboarding process.

Coverage amount

Coverage amount is the total amount of money that your insurer promises to payout if the event you are insured against happens. For example, if you take out a funeral cover for R20 000, this means that the insurer will pay R20 000 in the event of your death.

Benefits

Benefits refer to the gains you experience or receive by virtue of owning a certain cover.

The basic benefit of having funeral cover is the peace of mind of knowing that your family will not have to incur debts when the unfortunate event of losing a loved one happens.

Other benefits may include cashback, airtime, counselling, paid-up benefit, funeral support, unveiling benefits, etc.

ZarfinCo in partnership with Old Mutual offers funeral cover from as little as R29 p.m.

Click here to learn more about the benefits https://www.zarfinco.com/

By: Thando Dumane

Published on: 11/01/2023

You Think you don’t need cover? Re-think!

You Think you don’t need cover? Re-think!

So you think you do not need cover? Re-think! Suze Orman illustrated that you need life insurance and funeral cover if you have children, spouses, or parents who depend on your income.

Jeremiah Say said," Insurance is your responsibility to your family and loved ones, you may hate it, but it is your responsibility". It is appreciated that one doesn't purchase life insurance products because they are going to die but because the ones they love continue to live.

To this end, Zarfinco, in partnership with Old Mutual and Safrican, is an accredited insurer offering affordable and easily navigated insurance products. Our primary goal is to provide the best rates at affordable prices so we can cover the general public. If you think you cannot afford a funeral plan or Life cover, then Zarfinco is the best insurer for you. Let us do an affordability assessment to align the various products with your particular needs.

Getting insured with Zarfinco is easy, and the process is simplified because we have a qualified call centre team that will help you navigate the process with affordable plans for you to choose from.

You can live your life stress-free with the knowledge that you're covered.

We offer funeral covers ranging from R5 000 to R70 000, from as little as R29 per month. We have different plans that allow you to cover yourself, your family, and extended family members. We also have other coverage plans that give you cash-back benefits. We are an insurer that aims at making your life easier and simpler. Get a quote on Zarfinco or contact us at (010) 880 6090.

By: Eunice Mukondeleli

Published on: 18/01/2023

Did you know

Did you know

THINGS YOU NEED TO KNOW ABOUT YOUR COVER:

Policy number

A policy number is a unique number that identifies your particular cover. The policy number is quoted on your funeral cover document, however, the agent should give it to you immediately after you finish the telephonic/face-to-face onboarding process.

Coverage amount

Coverage amount is the total amount of money that your insurer promises to payout if the event you are insured against happens. For example, if you take out a funeral cover for R20 000, this means that the insurer will pay R20 000 in the event of your death.

Benefits

Benefits refer to the gains you experience or receive by virtue of owning a certain cover.

The basic benefit of having funeral cover is the peace of mind of knowing that your family will not have to incur debts when the unfortunate event of losing a loved one happens.

Other benefits may include cashback, airtime, counselling, paid-up benefit, funeral support, unveiling benefits, etc.

ZarfinCo in partnership with Old Mutual offers funeral cover from as little as R29 p.m.

Click here to learn more about the benefits https://www.zarfinco.com/

By: Thando Dumane

Published on: 18/01/2023

Prepare for the inevitable with the help of Zarfinco

"When you are young, fit, and full of drive, it’s easy to think that “it will never happen to me” but this is the myth of invincibility” ~DSC Singapore

Most families bury their loved ones with much frustration and stress caused by planning a funeral on a shoestring or with no budget. This is especially prevalent amongst the youth. Zarfinco is here so that your family does not go through such trauma.

Zarfinco is an insurance company that offers comprehensive Funeral cover and life cover plans that ranges from as little as R29 per month. We have many options that allow you to choose the coverage plan that fits your budget and living arrangements.

Getting cover is something you do because you want to protect your family for the future, and choosing the right cover is never easy. You need to research and choose the insurer that cares for more than just your money, and Zarfinco is the better choice.

Joining the Zarfinco team is easy. Visit our website https://www.zarfinco.com/ or call 010 880 6090 for a quote.

By: Eunice Mukondeleli

Published on: 25/01/2023

DID YOU KNOW?

THINGS YOU NEED TO KNOW ABOUT YOUR COVER:

DID YOU KNOW?

THINGS YOU NEED TO KNOW ABOUT YOUR COVER:

Waiting period

A waiting period is a qualifying period that needs to pass before certain elements of the cover come into effect.

For example, with a funeral cover, a waiting period of 6 months may apply on natural death before the cover pays out.

Claim Process

A claim is a formal request by a policyholder to the insuring company in the event that the insured event happens. Therefore, a claims process is the procedure that starts the moment the policyholder makes a claim.

A claim can be made over the phone or at the insurer’s office. A funeral cover claim requires a death certificate or notice of death and the policy number in order to be processed.

Click here to learn more about the benefits https://www.zarfinco.com/

By: Thando Dumane

Published on: 25/01/2023

Health and Wealth covered with Zarfinco

Health and Wealth covered with Zarfinco

Successful people live the life they want, not wondering how things can change for their families when they are gone. Zarfinco allows you the odds to continue taking care of your family even in your absence. Zarfinco has many policies that cover you, your family, and extended family members.

Zarfinco is an insurance company partnered with Old Mutual and Safrican to offer Life and Funeral cover at affordable premiums.

There is no such excuse as “I cannot afford cover” as getting life insurance and the Funeral cover has been made accessible to all. With plans that start from as little as R29 per month, you can live your life stress-free with the knowledge that your family is covered.

“You do not buy life insurance because you are going to die, but because those around you are going to live” ~ unknown.

Getting insurance gets insurers that your family continues to live wealthy and in good health. For a quote, visit our website at: https://www.zarfinco.com/ or call us on 010 880 6090.

By: Eunice Mukondeleli

Published on: 08/02/2023

DID YOU KNOW?

THINGS YOU NEED TO KNOW ABOUT YOUR COVER:

DID YOU KNOW?

THINGS YOU NEED TO KNOW ABOUT YOUR COVER:

Exclusions

An exclusion is an event that a cover will not make any payouts for. Funeral cover does not exclude any death caused by a pre-existing health condition, however, death by suicide can be excluded for a period of 12 months from the date the policy became active.

Premium & Premium Payment Dates

A premium is the amount that a policyholder pays to an insurer, commonly paid monthly.

Thus, a premium payment date is the date on which the policyholder commits to pay his premium each month.

If the insurer does not receive the premium on the agreed premium payment date, the insurer will notify the policyholder of the non-payment within 15 days. Click here to learn more about the benefits https://www.zarfinco.com/

By: Thando Dumane

ZARFINCO- A C0VERED YOU IS A FEARLESS YOU

ZARFINCO- A C0VERED YOU IS A FEARLESS YOU

Whether you are starting or are in the twilight of your career and looking forward to retirement, the actuality of managing your life is never easy because of the many things you must figure out. Acquiring the right insurance coverage should not add to your anxiety.

This article aims to educate you on why Zarfinco, with its partners, is the right insurance company for you.

Affordable premiums

ZarfinCo’S Partnership with Old Mutual and Safrican offers the most affordable premiums. We sell funeral covers ranging from R50 00.00 to R70 000.00, from as little as R29 per month. The minimum entry age for the policyholder is 18 years, and the maximum entry age for the policyholder is 65. You can add your parents or extended family up to the age of 84.

Money Back Guarantee

Our cover pays an amount equal to all the premiums we have already received for the portion of protection that does not pay because of waiting times. These are payable if the death is due to an accident within the waiting period or suicide six months after the joining date.

Grocery and Education Benefits

All these benefits can be added (at an extra premium) to new single adult and family funeral plans. These grocery and education benefits pay 12 equal monthly payments to the recipient when an insured person dies.

Claiming process

Our underwriter partners have simplified the claiming process to make things easier. The claiming process is as easy as calling Old Mutual or Safrican, sending a WhatsApp text, dialling a USSD number, or visiting the branch with the required documents.

We are all for making things easy for you.

Choose the correct option, Zarfinco. Visit us at: https://www.zarfinco.com/

Published on: 15/02/2023

By : Eunice Mukondeleli

Did you know

THINGS YOU NEED TO KNOW ABOUT YOUR COVER:

Did you know

THINGS YOU NEED TO KNOW ABOUT YOUR COVER:

Cover Lapsing & Grace period

Lapse is a term that describes a situation whereby the cover is no longer active which means no claim or payouts can be made.A cover can lapse due to non-payment of premiums.

However, policyholders are allowed a grace period before their cover lapses. A grace period is a defined amount of time that a policyholder is given to pay any late premiums.

Cover Reinstatement

Reinstatement refers to restoring a cover that may have lapsed due to non-payment.

A cover can be reinstated after the grace period has ended and if the cover is no longer active.

By: Thando Dumane

The flexibility to choose the insurance coverage that fits your budget~ Zarfinco

The flexibility to choose the insurance coverage that fits your budget~ Zarfinco

If you think that because insurance is expensive, it should be an optional item in your monthly expenses. You are dangerously mistaken. "Life insurance protects your family, spouse and children from the potentially devastating financial losses that could result if a tragic event happens to you. It provides financial security, helps to pay off debts, helps to pay living expenses, and helps to pay any medical or final expenses". ~ New York Life. Funeral policies, on the other hand, pay out much faster than life insurance policies. They go towards paying immediate funeral expenses while the estate, which includes the life cover policies, is being wound up, so your family can avoid shouldering significant debt from a funeral.

Zarfinco has partnered with Old-Mutual, and SAfrican to offer you the flexibility to choose the coverage that fits your budget and living arrangement. Here are options from which you can choose:

Care Plan is convenient for first-time cover owners. If you have just started working and are looking into starting your family, this is for you. The monthly premiums start from as little as R26, paying R5 000 to R50 000. You can increase the monthly premiums depending on the coverage amount you want.

A standard plan has more benefits than a care plan. The monthly premium starts from R29 and pays R5 000 to R70 000. The minimum entry age is 19, and the maximum is 65, and you qualify for the premium back benefit.

This plan is more advanced, has many benefits, and is affordable. You qualify for premiums back and a money-back guarantee. This cover starts at R36, and the entry age is 19 to 54. (Terms and conditions apply).

If you want to learn more about these premiums or see the cover that fits your budget, Zarfinco is your best choice.

Visit us at: https://www.zarfinco.com/the-hot-hub-news-letter or call us at 010 880 6090

Published by: Eunice Mukondeleli

Published on: 22/02/2023

Did you know

THINGS YOU NEED TO KNOW ABOUT YOUR COVER:

Did you know

THINGS YOU NEED TO KNOW ABOUT YOUR COVER:

1. Benefits

Benefits refer to the gains you experience or receive by virtue of owning a certain cover.

The basic benefit of having funeral cover is the peace of mind of knowing that your family will not have to incur debts when the unfortunate event of losing a loved one happens.

Other benefits may include cashback, airtime, counselling, paid-up benefit, funeral support, unveiling benefits, etc.

ZarfinCo in partnership with Old Mutual offers funeral cover from as little as R29 p.m.

Click here to learn more about the benefits https://www.zarfinco.com/

By: Thando Dumane

Put your trust in ZarfinCo

Put your trust in ZarfinCo

Young people often overlook the importance of life insurance and funeral coverage. However, getting these types of coverage can provide financial security and peace of mind in the event of an unexpected death. With life insurance, surviving family members can receive a lump sum payment to help with funeral costs, medical bills, and other expenses associated with the death. A funeral cover helps pay for burial or cremation services along with any related expenses. By investing in life insurance and funeral cover now, young people can ensure that their loved ones are covered in the event of their untimely death while keeping their monthly contributions to a minimum.

Young people often think that life insurance and funeral cover are too expensive or unnecessary, but this is not the case. Getting life insurance and funeral cover at a young age can be a great way to ensure that your family is taken care of in the event of your death. Not only will it provide financial protection for your loved ones, but it can also give you peace of mind knowing that they will be taken care of if something were to happen to you. Furthermore, there are many affordable options available for young people looking to get life insurance and funeral cover.

Life insurance and funeral cover are essential for young people to secure their future and the future of their loved ones. It is important to start planning to ensure that you are adequately covered in case of any eventuality.

Life insurance provides financial protection for your family in the event of your death, while funeral cover helps to offset the costs associated with funerals, such as burial fees and other expenses. With life insurance, you can make sure that your family is taken care of financially if something happens to you unexpectedly. Funeral cover can help provide peace of mind by ensuring that your loved ones don't have to worry about finances when they are mourning your loss.

Getting life insurance and funeral cover now will help protect you and your family against any unforeseen circumstances in the future.

Put your trust in ZarfinCo

"Would you agree that the only person who can take care of the older person you will someday be - is the younger person you are now?" ~ unknown.

ZarfinCo offers Life cover and insurance policies that best fit your pocket. There is no need to stress about your finances. ZarfinCo ensures that the absence felt by your family doesn't include missing your financial contribution to their lives.

Choose the insurance company dedicated to using all its resources to make your claim process as smooth as the premiums you have been paying. Choose Zarfinco.

For an obligation-free quote, visit: https://www.zarfinco.com and our team will help get you protected.

Published on: 01/03/2023

Did you know

THINGS YOU NEED TO KNOW ABOUT YOUR COVER:

THINGS YOU NEED TO KNOW ABOUT YOUR COVER:

What is a funeral cover?

Funeral cover is an agreement between an insurer and a policyholder that guarantees to assist with covering the costs of the funeral arrangements of the insured, in exchange of premiums paid by the policyholder.

What is a life cover?

Life cover is a contractual agreement between an insurer and a policyholder that guarantees that the insurer will pay a specified value amount to declared beneficiaries if a death, disability, or health event happens; in exchange of premiums paid by the policyholder during his/her lifetime

Your life is precious, Protect it with Zarfinco

Your life is precious, Protect it with Zarfinco

Life is precious and it should be protected. That's why Zarfinco Insurance Company provides the ideal protection at a price you can afford. With their affordable rates and excellent customer support, you can rest assured that your life is safe and secure.

Zarfinco Insurance Company offers a wide range of insurance policies to suit your needs, so you can find the perfect coverage for yourself or your family. Whether you're looking for health, auto or home insurance, they have the right plan for you.

Don't take any chances when it comes to protecting your life - make sure that you get the best coverage with Zarfinco Insurance Company today!

For more information about our policies, plans, and premiums, visit: https://www.zarfinco.com/about-us or call us at 010 880 6090, and our friendly agent will get back to you.

By: Eunice Mukondeleli

Published on: 08/03/2023

Did you know

THINGS YOU NEED TO KNOW ABOUT YOUR COVER:

THINGS YOU NEED TO KNOW ABOUT YOUR COVER:

Do you need both covers?

Yes, you do need the life insurance policy and a funeral policy.

Life cover does not substitute Funeral cover or vise-versa as they both fulfill different purposes.

ZarfinCo in partnership with Old Mutual offers funeral cover from as little as R29 p.m.

Click here for more https://www.zarfinco.com/

By: Thando Dumane

Looking for insurance?

Look no further.

This article discusses different ways to cover expenses that arise for your eventual death and funeral, including life insurance and funeral cover.

Life insurance can provide financial protection for your family in the event of your death, while funeral cover helps to offset the costs associated with funerals. - Zarfinco is here to help simplify the process of choosing life insurance and funeral cover by offering a range of options. If you want a life insurance policy, we can help you choose the right coverage and make sure that you buy enough insurance to cover your final expenses. Zarfinco offers a guide to funeral cover and life insurance so that you can compare costs and

find the best kind of coverage for your needs. Zarfinco helps simplify the process of choosing life insurance and funeral cover. We provide funeral insurance that is intended to cover the burial fees and other expenses associated with funerals and burials, as well as provide financial protection for your life expenses. Our insurance policy offers coverage for burial services, and allows you to leave additional money behind in order to cover other related funeral costs. With Zarfinco, you can rest assured that all is taken care of in the event of death, leaving you with peace of mind knowing that your funeral expenses are covered. Our standard life insurance policies also provide coverage for funerals and burials, allowing you to leave additional money behind in order to fund any additional services or costs related to the event.

Zarfinco offers products to help you buy funeral insurance and cover your existing debts, as well as other expenses that may arise. With life insurance, you can be sure that you are leaving money behind for your final expenses and leaving your family free from the burden of being responsible for these costs. Our funeral decisions package helps to make sure that all of your wishes will be carried out in the event of death, giving peace of mind to those left behind.

Zarfinco agents are able and ready to assist you in your journey to complete coverage and they can be reached on:

(010) 880 6090 or visit our website www.zarfinco.com to begin the process.

By: Eunice Mukondeleli

Published on: 15/03/2023

Did you know

THINGS YOU NEED TO KNOW ABOUT YOUR COVER:

THINGS YOU NEED TO KNOW ABOUT YOUR COVER:

Things you need to know about your cover:

Policy number:

A policy number is a unique number that identifies your particular cover.

The policy number is quoted on your funeral cover document, however, the agent should give it to you immediately after you finish the telephonic/face-to-face onboarding process.

Example of a policy number

A policy number is a unique number that identifies your particular cover.

The policy number is quoted on your funeral cover document, however, the agent should give it to you immediately after you finish the telephonic/face-to-face onboarding process.

Example of a policy number

ZarfinCo in partnership with Old Mutual and SAfrican offer funeral cover from as little as R29 p.m.

Click here for more https://www.zarfinco.com/

By: Thando Dumane

Published on: 15/03/2023

ZarfinCo in partnership with Old Mutual and SAfrican offer funeral cover from as little as R29 p.m.

Click here for more https://www.zarfinco.com/

By: Thando Dumane

Published on: 15/03/2023